Statewide - Fast 504 Loan

We help speed up the process to help get your 504 Loan FAST!

The SBA 504 Loan Program is a low cost, fixed rate loan program intended for owner-occupied commercial / industrial property purchases and new construction. This highly successful U.S. Small Business Administration (SBA) loan program is offered through a partnership program between a Certified Development Company (CDC) and a participating private lender (most often a bank). Statewide CDC partners with a wide range of leading lenders to make the SBA 504 Loan Program available to businesses.

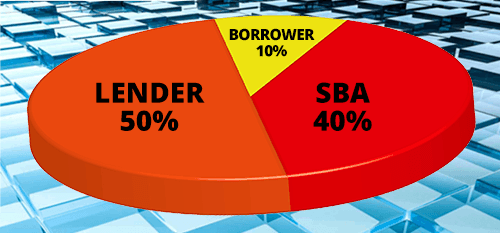

How is an SBA 504 Project Structured?

The participating lender (bank) typically finances 50% of the total project cost through a first deed of trust loan. Statewide CDC provides second deed of trust financing for up to 40% of the total project cost with an affordable, long term fixed rate, fully amortizing SBA-backed loan. The borrower typically puts down as little as 10% of the total project cost.

How do I get Started?

Prequalification is the first step in obtaining SBA 504 financing for your project. To perform a prequalification, we request the following information.

- Three years corporate/company tax returns (Schedule C’s in the case of a sole proprietorship)

- Interim (current year) financial statements (no older than 60 days)

- Personal financial statement(s) "Click Here" for form (from owners of 20% or greater of the business)

- Three years individual tax returns (from owners of 20% or greater of the business)

- Schedule of business debt "Click Here" for form

- Description of property and building improvements (if applicable)

- Contact your SBA loan expert to get started "Click Here"

504 Loan – Additional Links

Rates

504 Debenture Rates

Sample Project

Typical 504 project